You have lots of choices when buying Maine car insurance.

You can buy a policy online in a few minutes from GEICO, Progressive and others without ever talking to a human. But do you really know what you bought?

You can talk to a local insurance agent and buy from them. But, won’t they pressure you into buying something more expensive? How do you know which is better?

The GEICO Way – Buying Direct

When you purchase a GEICO, Progressive or similar policy online or on the phone, you’re buying directly from the insurance company. Service is usually via mobile app, website or call center.

PROS

- Speed – You can usually purchase insurance in one session if you want to. You get instant proof of insurance, and you’re on your way.

- Self-service convenience – Most direct companies have very good apps and web sites. You can make policy changes, pay bills and view insurance documents online.

- 24/7 Access – national insurers operate call centers at all hours. You can make a policy change at 2 AM if you want.

- National footprint – If you’re someone who moves around a lot, this may work well for you.

- Low Cost, Bare Bones Options – If you’re looking for the absolute minimum coverage required by law, these companies often are the cheapest.

CONS

- Lack of Choice – Direct companies only sell products from one company. To change companies, you have to start from scratch with a new insurer.

- No Advocate – Any contact you have is with an employee of the insurance company. They’re naturally going to look out for their employer’s interest, not yours. They aren’t likely to tell you if there’s a better option for you, unless it benefits them as well.

- Limited Advice – GEICO and other direct insurers have national call centers with thousands of agents. You’re unlikely to talk to the same person twice. Since you only speak with that person once, they don’t know your situation, preferences or challenges. They sure don’t know the difference between Dunstan Corner and Morrill’s Corner. As a result, it’s harder for them to provide personal advice. You could end up buying much less – or more – insurance than you need.

- Limited Products – Most national direct companies focus on a few types of insurance, with a limited appetite. If you buy a condo or a snowmobile, or start a business, they may no longer be able to help you. Then, you have to start over with a new insurance company.

- Pressure to Buy – You might think you can avoid sales pressure by getting an online insurance quote. But, have you ever gotten a quote from a direct insurer and didn’t buy? You get BLASTED by emails for days. Buy! Buy! Buy!

INSURANCE AGENTS and BROKERS

You can also buy insurance from a local Maine agent or broker. Some Maine insurance agents represent only one company, like State Farm or Allstate. These are sometimes called “exclusive agents” or “captive agents”. They are a hybrid. They share some limitations and advantages of both direct companies and independent agents. For example, because they only represent one company, they’re unlikely to advocate for you vs. the insurance company. And, they can’t offer a choice. Plus, they’re often paid on sales commission – so be prepared for lots of follow up calls and emails asking you to buy. But, once you’re a customer, it’s easier to establish a relationship with these local people than with a direct company.

Independent Agents (Trusted Choice Insurance Agents) are local business owners who represent several insurers. Insurance companies that rely on independents to sell their products don’t advertise to the public much. You may not have heard of some. That doesn’t mean that the household names are any better, though.

PROS

- Choice – Independent agents represent many different companies. They can help you pick the best value and fit for your situation. Bundle when it makes sense, or shop a la carte when it doesn’t. Need to insure something unusual or different than your previous situation? Your independent agent can help. Want to change insurance companies? Your independent agent won’t miss a beat. You’re not starting from scratch.

- Consistency – Most independent agencies are small local offices. You often work with the same person, year in and year out. Prefer texts to email? Move to camp every summer? Like to stop in to review your insurance in person? Your local agent gets that.

- Advocacy – Your agent is not employed by the insurance company. They’re free to advise you what’s best for you, even if it’s not best for your insurance company. They can answer questions and advise you without raising any flags at the insurance company.

- Personal and Local – Your agent lives and works where you do. They know what’s happening in your world. They can respond to local weather and economic events, and recommend local contractors and other businesses. You’ll never have to explain more than once where you live, or at which grocery store you had that parking lot accident.

CONS

- One location – If you move around the country frequently, a local independent agent’s value diminishes. They are typically licensed to sell insurance in one or two states.

- Limited Access – Your agent’s office is not open 24/7 like the national call centers. Most insurance companies (direct and independent agency channels) DO have 24 hour claim reporting. Also, many independent agents are now offer 24/7 access to policy documents for after-hours viewing and questions.

- Slower? – If you’re looking to get insurance in the next 15 minutes, and are less concerned about getting the absolute best fit, a direct insurer like GEICO or Progressive may be best for you. Because an independent agent represents several companies, it can take longer for them to quote your insurance. But, you’ll probably get 5 or more quotes, instead of just one.

Pushy Salespeople?

Insurance agents all get paid to sell insurance. It doesn’t matter if you’re talking to a GEICO call center agent or a local Allstate agent. But not every agent is paid the same way.

At Noyes Hall & Allen Insurance, we pool our commissions and pay our agents a salary, with a small percent of their income tied to our overall results. That way, they’re free to advise you what’s best for you, even if it’s not us. We won’t pressure you to buy. Sure, we have goals, and we like to reach them. But we think if we treat people fairly and to use our insurance knowledge to help people, we’ll win more than we’ll lose in the long run. A short-term sale success is nothing compared to a long-term client.

Does it Cost More to Buy From an Insurance Agent?

No single insurance company always has the lowest price, even though their advertising might make you think so. Buying insurance direct from the company sounds like it might save money, because there’s no agent involved. But the facts aren’t so clear. GEICO spends billions a year on advertising. Independent agency companies pay commission to local agents. Both are paid by the premium you pay to the insurance company.

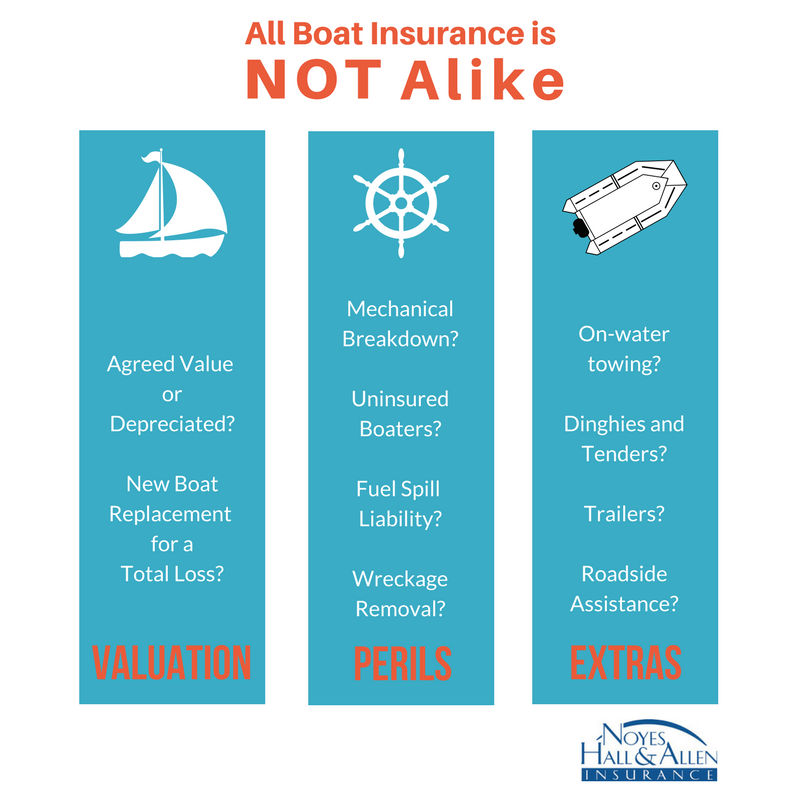

Don’t Forget Coverage

Insurance coverage forms vary. Some companies don’t cover you if you’re delivering pizza. Others do. Some uninsured motorist coverage can be 50% less than another company, even though the limits look very similar on paper. Which do you think costs less?

Do You Understand Your Insurance?

When you bought insurance, you made a lot of choices on the fly. Your job may have changed. You might have traded vehicles. You may have gotten married, or divorced. Do you know what coverage you have? Do you know if your policy doesn’t cover enough – or too much?

If you live in Southern Maine and have questions about your insurance, contact a Noyes Hall & Allen independent insurance agent at 207-799-5541. We’ll help you understand what you have and decide what you need. It doesn’t cost a cent to get a second opinion from Noyes Hall & Allen. And, if you do choose to do business with us, you’ll be supporting a local business. That keeps some of your premium dollars in Greater Portland, instead of some far-off insurance company home office.

Noyes Hall & Allen is independent and committed to you.

“There’s a Lid for Every Pot”

“There’s a Lid for Every Pot”

Insure the weather.

Insure the weather.  Love Your Volunteers

Love Your Volunteers