|

Most of us have said something in the past that we wish we could take back. Years ago, we could hope that once said, the words went no further. These days, your comments can last for years, and be shared among millions. With so many of us using Twitter, Facebook and other social media, ill-advised words and videos can spread at blazing speed.

Hurtful Words Can Be CostlyBullying Facebook updates, accusatory tweets, teasing posts, or videos revealing private information about someone can expose you to liability under slander, libel or invasion of privacy laws. The most recent public example of this is the guilty verdict against the New Jersey college student who posted video of his college roommate, creating ridicule that led to the roommate’s tragic suicide. What if your child was accused of one of these crimes? You may be surprised to find that a standard Maine homeowners insurance policy wouldn’t provide protection for this.

A Small Coverage Addition Makes a Big DifferenceMaine homeowners policies provide liability protection against bodily injury and property damage due to negligence. Damage to someone’s reputation doesn’t fall into either category. That’s why our South Portland Maine Insurance agency recommends that our clients choose Personal Injury coverage. What is Personal injury insurance? It protects you against accusations of slander, libel, defamation of character and invasion of privacy. It can pay the damages in a civil suit, and more important, the legal costs of defense. Personal injury coverage is usually an add-on endorsement. The cost is usually about $25 per year – a bargain for up to $500,000 in protection.

Talk to Your Children About Online BehaviorOf course, the best defense against these kinds of accusations is to stay away from risky behavior. Talk to your children about social media, how they use it and what’s expected of them. Let them know how their behavior could impact their own reputation – not to mention your insurance. Some parents choose to actively monitor their children’s computer activities. Various commercial software programs are available to parents who want to closely monitor what their children’s online activities.

No matter what you choose to do, we should all encourage respectful discourse and behavior – online and “IRL” (In Real Life). For more information about Personal Injury Insurance in Maine, contact a Noyes Hall & Allen agent at 207.799.5541.

|

Author: admin

6 Best Practices to Deal With Maine’s Rising Property Insurance Rates

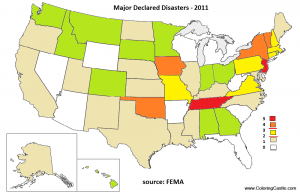

Most insurance companies doing business in Maine would like to forget 2011. Maine narrowly escaped many of the disasters that plagued other Northeastern states (one Maine insurance executive tells of nervously, repeatedly “refreshing” the online map of Hurricane Irene’s storm track). Still, virtually every insurer was affected because they do business in those neighboring states.

Remember the terrible flooding in Vermont? Hurricane Irene in southern New England? The tornadoes in Central Massachusetts? Widespread power outages from falling snow-covered tree limbs? Insurance companies do. They paid all those claims.

Many people don’t know that insurance companies also buy insurance – called reinsurance – to protect themselves from financial disaster. Reinsurance spreads the cost of risk throughout the world, leveling loss experience. Reinsurance works: despite the recession and the heavy losses, insurance companies remain financially solvent and able to pay claims.

Unfortunately, 2011 set a world record for disasters . Losses were $105 billion, the highest number ever. About 1/3 of those losses, and 4 of the top 10 events, were in the US. That means that reinsurance companies are now increasing the rates that insurance companies pay for property reinsurance. Of course, that translates to higher homeowners and business property rates for you and me. So, what can you do?

6 Ways to Help Offset Rising Property Insurance Costs

- Don’t overinsure. Your Maine business property insurance agent or homeowners insurance agent can help you determine the insurable replacement cost of your property, so you can adjust your protection accordingly.

- Compare rates. There are 2 ways to do this: call around yourself; or consult a Trusted Choice independent insurance agent. This kind of insurance agent represents several insurance companies, and can compare prices and coverage for you.

- Get the discounts you deserve. Don’t pay too much by failing to get the business or homeowners insurance discounts you’ve earned. Have you recently replaced your roof, electrical, heat or other system? Installed an alarm or a generator? All of these improvements may qualify for discounts. Talk to your agent, and ask if there are other discounts available.

- Combine and save. Most insurers give a discount when they insure both your property and vehicles. That goes for business or personal insurance. If you own coastal, seasonal or secondary property, some preferred insurance companies will accept you if they insure your primary home, too. This can rescue you from paying higher non-standard rates with another insurance company.

- Choose deductibles wisely. If you’ve owned your property for a long time, you may have more financial ability to repair small losses (it’s not a good idea to file multiple, small claims anyway). If so, ask your agent how much you could save by increasing your property deductible.

- Maintain your property. It should go without saying, but deferred maintenance leads to claims, and claims lead to higher premiums. Replace your roof or heating system before it causes a loss. Clear leaves from your gutters every fall to prevent ice dams. Regular paint and upkeep can prevent trouble later.

Trusted Choice Insurance Agent Video Debuts in Portland, Maine

We’re enjoying this new Trusted Choice video, which highlights the advantage of using a local independent insurance agent. Not only will you get personalized advice from a local professional, but you have the option of choosing from among several insurance companies at once.

We are proud to be your Portland, Maine area Trusted Choice insurance agent. For answers to your insurance questions, contact Noyes Hall & Allen Insurance at 207.799.5541.

Is Your Valentine’s Day Jewelry Insured Properly?

Americans spent $4.1 billion on jewelry this Valentine’s Day, the National Retail Federation estimates. If you were one of the lucky recipients, you might be wondering: does my homeowners or renters insurance cover my jewelry?

The short answer is “somewhat”. If your jewelry burns up, or is blown away in a tornado, it’s covered. But that’s not usually what happens to jewelry. Most commonly, jewelry is stolen or lost, or a stone falls out of its setting.

What Kind of Jewelry Should I Insure Separately?

More expensive jewelry pieces should be separately insured, for several reasons. Because they’re subject to limitations on your homeowners policy, they may be only partially covered – or not at all. Certainly, any jewelry with precious stones, especially valuable ones, should be separately insured.

How Much Does Jewelry Insurance Cost?

Jewelry insurance is surprisingly affordable. Insuring $5,000 of jewelry on your Portland Maine renters insurance, condo or homeowners insurance usually costs less than $40.00 a year.

Do I Need to Have My Jewelry Appraised?

Jewelry pieces valued greater than $5,000 must be appraised to be added to most insurance companies’ policies. Insurance companies also require appraisals about every 5 years. Gemstone, gold, platinum and silver prices fluctuate based on popularity, supply and demand, and condition. Appraising your jewelry makes sure that your coverage keeps pace, and also provides an opportunity to have the settings, strands and gems checked. This can avoid the heartbreak of lost jewelry.

Should I Take Pictures of My Jewelry for Insurance?

Photographing your jewelry is always a good idea. Even if your pieces were not separately insured, photographs can help the police recover stolen jewelry, or help a claim adjuster identify exactly what you had prior to a loss.

Our Portland, Maine area insurance agency hosts periodic free jewelry inspection events, where you can have your settings checked, and jewelry cleaned and photographed for insurance purposes. If you would like to be notified of future events, like Noyes Hall & Allen Insurance on Facebook.

For answers to your personal or business insurance questions, contact our experienced Maine insurance agents at Noyes Hall & Allen Insurance: 207-799-5541. We represent many different insurers, so we can offer a solution customized to your needs and situation.

When an Employee Layoff Goes Bad

Bill runs a café on the West Side. Since a nearby hi-tech facility had a major layoff, lunch business has dropped 25%. In fact, Bill had to let Willie, one of his waiters go last week. Now, Bill’s wife Elaine stands in the kitchen with a concerned expression on her face and an official-looking letter in her hand. Willie hired an attorney and filed a lawsuit alleging wrongful termination and discrimination.

Elaine calls the café’s insurance agent. Good news! Bill & Elaine followed their agent’s recommendation by adding Employment Practices Liability Insurance (EPLI) to their portfolio of coverage last year. When the agent explained that the average cost of defending a groundless lawsuit is $20,000, they knew they couldn’t afford the risk. Their agent explained that the insurance company would respond on their behalf, hire a lawyer if necessary, and pay any damages if they are found liable. Bill and Elaine just avoided a huge expense one that could have forced them to close their business.

Are you smart, like Bill and Elaine? Has your insurance agent recommended EPLI coverage to you? If not, you might consider:

5 Myths About Employment Practices Lawsuits

1. Employee Lawsuits Are Rare

Employment related lawsuits happen more than you think. Six in ten employers in the U.S. have faced an employment-related lawsuit in the past 5 years.

2. Only Large Employers Get Sued For Employment Practices

Nationwide, more than 40% of employment-related practices claims are brought against employers with fewer than 100 employees.

3. Employee Lawsuits Don’t Happen in Maine

Think again. The Maine Human Rights Commission or Maine Workers’ Compensation Board handle more than 800 employment-related practices complaints every year.

4. It’s Covered by Liability or Workers’ Comp Insurance

Unless you have specifically purchased EPLI coverage, the costs of defense or damages are NOT covered by standard Workers Comp, General Liability or Professional Liability insurance policies.

5. EPLI Insurance is Expensive

Depending upon the type of business you operate, Maine Employment-Related Practices Insurance costs as little as $30 per employee per year – or $0.58 per weekly payroll period.

What does EPLI Cover?

- Legal Representation to defend you against claims from current, former or prospective employees, including:

- discrimination (age, sex, disability, race, religion, etc.)

- wrongful termination

- sexual harassment or hostile work environment

- Damages you’re legally obligated to pay.

- Court costs and related expenses.

- Some policies also offer counsel with an employment law professional to help you during the hiring employment and termination process.

If you have employees, your business is at risk. For answers to your Maine employment liability insurance questions or Maine workers compensation insurance questions, call Noyes Hall & Allen at 207-799-5541.

Maine Insurance Dept.: ME Car Insurance Rates Remain Low

Maine drivers pay some of the best auto insurance rates in the U.S., according to this press release from the Maine Insurance Department. While the individual rankings seem to differ from study to study, it’s clear that Maine’s car insurance and motorcycle insurance rates are in the bottom 20%.

Why Are Maine Auto Insurance Rates Low?

A lot of factors go into the rates each of us pays for car insurance or motorcycle insurance. Your location, driving record, the type of vehicle you drive, your age and gender – even your credit score – all play a part. So, it’s impossible to generalize. But, based upon our experience as a Greater Portland Maine independent insurance agency, we have a theory why Mainers pay lower auto insurance rates. We think it has a lot to do with Maine’s culture of responsible behavior. Mainers are less litigious, and more likely to buy insurance themselves, than other Americans. That helps keep insurance rates low for all of us.

How Do Your Maine Auto Insurance Rates Compare?

Insurance companies change their rates and underwriting rules constantly. The only way to tell if you’re paying a good auto insurance rate or motorcycle insurance rate is to compare. Fortunately, we are an independent agency representing many different auto insurance companies. We also represent Progressive and Dairyland, some of the top motorcycle insurers in Maine. We do the shopping for you, and can present multiple quotes at one time. If you want to do your own research first, you can even get Maine car insurance quotes from 5 different companies at once on our web site. There’s no pressure or obligation to buy (although we’re always ready to answer any questions).

If you live in Greater Portland or elsewhere in Southern Maine and have insurance questions, contact Noyes Hall & Allen at 207.799.5541. An experienced local insurance agent is ready to provide personal service.

Avoiding Used Underwear & Red Cross Socks for $10 a Month

You rent a house, condo or apartment. Maybe you’ve been meaning to buy renters’ insurance. Or maybe, you’ve been thinking something like this:

My Stuff Isn’t Worth Much

You think you have minimal furniture, electronics and clothes. But, you acquired it a little at a time; maybe you even bought some of it used. After a fire, you’re going to have to replace it all at once, and in a hurry. Even a 1-bedroom apartment easily holds $10,000 of stuff – more if you have a decent computer or a hobby like photography, mountain biking or music. That’s more than most of us have in the bank.

When you get Maine property insurance buy replacement cost coverage; it’s always worth it. Otherwise, the insurance company pays you “actual cash value”: the difference between replacement cost and depreciated value.

Replacement cost = cost of new underwear in the store.

Depreciated Value = what I’d pay for the stuff in your underwear drawer (not much).

My Landlord’s Policy Covers Me

Your landlord’s insurance (IF they have any) covers them, and them alone. Whether the plumbing leaks on your sofa, a fire burns up your apartment, someone steals your computer, or someone slips on an ice cube in your kitchen, you have no insurance unless you buy it yourself.

I Can’t Afford It

Renters’ insurance is cheap: often less than $10.00 a month. That’s a few cups of coffee. Know what you really can’t afford?

- To replace all your stuff (“new for old”, right?)

- To rent a hotel room while your apartment is damaged.

- Medical bills if someone falls in your house or your dog bites someone.

- That fancy vase you accidentally knocked over in that gift shop on Exchange Street.

My Friends/Family/ The Red Cross Would Help Me

Your friends and family rock. And they mean well. But, do you really want to wear your sister’s hand-me-downs; move back into your old bedroom in your parents’ house; or have your brother say ” you owe me one”? No, you don’t.

The Red Cross is amazing. There they are on the TV news, delivering clothes and putting people up for a few days when they’re burned out of their homes. But, you probably don’t want to be that poor girl on the news. It’s always better to pick out your own clothes and choose your own place to stay.

If you live in the area of Portland Maine, renters insurance quote is just a few mouse clicks away. Or, you can contact Noyes Hall & Allen Insurance at 207-799-5541. We represent several insurance companies, so we can compare to find the best deal for you.

What If You Are Hit by Someone With No Insurance?

The Uninsured Motorist coverage in your Maine auto insurance policy also protects you against uninsured and underinsured drivers. If someone hits you – their fault – and they have no insurance, your policy acts as if they had the same Bodily Injury liability limits you do, and pays for your bodily injuries, and those in your vehicle. It’s the same if the at-fault driver had low liability insurance limits, and you bought higher ones.

Isn’t Insurance Mandatory in Maine?

Yes, in Maine, car insurance is mandatory – at least liability insurance. Maine DMV requires proof of insurance to register your car. So everyone’s insured, right? Not really.

An estimated 4% of Maine drivers are uninsured – and that’s the 2nd best rate in the country. The Insurance Research Council estimated that nearly 14% of U.S. drivers had no car insurance at all.

Repairing Your Car

If you are hit by an uninsured driver, you’ll have to rely on your own policy’s collision coverage to repair your vehicle. That’s assuming that you have collision coverage on your vehicle. If not, you’re on your own to repair or replace your vehicle.

But that’s only half the story: what about the people who buy state minimum liability limits? Maine’s minimum limits are only $50,000 per person, $100,000 per accident, and $25,000 property damage. Is your vehicle worth more than the $25,000 minimum limit? What if the at-fault driver hits more than one vehicle? The minimum-limits driver’s policy only pays a total of $25,000 for all damage.

Out of Staters and Uninsured Motorist Coverage

Mainers are a pretty honest bunch. 96% of them carry at least minimal liability insurance. But what about people “from away”? What’s that nickname on Maine’s license plates again? Oh yeah…

Most of our out-of-state visitors are from the northeast, right? Click on the map below to enlarge it, and you’ll see that of the 10 states within an easy day’s drive of Maine, 2 do not require drivers to buy insurance AT ALL. Six more require per person Bodily Injury limits of $20,000 or less.

In Maine, Uninsured Motorist Bodily Injury coverage limits almost always match your own liability limits. If you have less than $500,000 per person in bodily injury coverage, and your agent hasn’t recommended that you increase your limits, maybe it’s time to contact Noyes Hall & Allen Insurance at 207-799-5541. We represent several different insurance companies, and will help you find the best value for your individual situation.

7 Ways to Trim Insurance Costs This Month

Thanks to Maine’s rural nature, mature population, low crime rates and high percentage of insured drivers, buyers of Maine auto insurance and home insurance pay some of the lowest insurance rates in the U.S. Still, there are ways to reduce your insurance costs. Avoiding accidents, tickets and homeowners claims is an obvious one. Here are some others.

Shop Around

Insurance is a very competitive business, as evidenced by the volume of advertising in the media, mail and internet. Every insurance company sets their own rates, and evaluates people differently. If you bought your policy directly from an insurance company (like Allstate, GEICO, State Farm, etc.), they only offer rates from their company. You’ll have to shop on your own.

Consult a Maine independent insurance agent who represents many companies; they will do the shopping for you. Many of them even have web sites where you can compare Maine home and auto insurance quotes from multiple companies.

The Best Time to Shop for Insurance

Your home and car insurance rates depend greatly upon your insurance score. That score is based on most of the same information as your credit score. The higher your score, the lower your car and home insurance rates. To get the best price, shop for insurance when your score is good.

In general, your insurance score decreases when you:

- Make a late payment on any type of loan or bill.

- Use a higher percentage of your available credit

- Apply for a loan or credit card (applying for insurance does NOT affect your score).

The time to get the best insurance rates is BEFORE refinancing or buying a home or car, and when your credit card balances are low.

Package Your Policies

Most insurers offer a significant discount for buying more than one policy from them. If you insure your property and your autos, you can often save $200 or more per year. The same goes for boats, snowmobiles, motorcycles or other types of insurance. Some insurers can even combine your billing, to simplify your bill-paying process, and reduce the clutter in your life.

Don’t Let Your Insurance Lapse

Every month, thousands of people get insurance cancellation notices due to non-payment of premium. This happens for reasons ranging from inattention to bills, to being on vacation, to simply not having the money.

If your insurance lapses, the insurance company may choose not to reinstate your coverage – especially if you’re a frequent slow payer. Few insurance companies will accept you after you have had a lapse in coverage – and they charge higher premiums to account for the additional risk. An easy way to save $250 per year or more: don’t let your policy cancel in the first place.

Communicate with Your Agent – Get the Discounts You Deserve

Your agent knows more about insurance discounts and rules than you do. They know which companies offer auto insurance discounts for driving few miles, owning a hybrid car, or a child being on the honor roll; discounts on home insurance for installing a generator or an alarm system; and which ones have best rates for young drivers. Some companies even offer a discount if you have your policy delivered electronically instead of by mail.

Certain life events affect your insurance, like sending a child off to college, inheriting a vehicle or property, and a child getting their driver’s license. By talking regularly with your agent, you will get advice on the best rate and coverage for your current situation.

Adjust Your Coverage

Pay attention to your deductibles and coverage. When you first bought your home, you may not have had the cash reserves to pay a $1,000 bill for damage. Perhaps now you do. Increasing your deductible from $500 to $1,000 can save hundreds of dollars a year.

Likewise, your auto policy may still have collision coverage on a vehicle with a very low book value. Your agent can help you estimate the savings by removing unneeded coverages or increasing deductibles.

Pay Bills Automatically

Most insurers now allow you to pay your insurance in monthly installments by Electronic Funds Transfer (EFT). Many charge very little – or nothing – for this option. Compared to the traditional “get a bill, write a check” method, this could save you $60 per year per policy. It also assures that your insurance continues without lapse, and improves your “on time payment” record, which helps your credit and insurance scores.

If you live in Southern Maine, and have questions about your insurance, contact Noyes Hall & Allen Insurance at 207-799-5541.

You Can’t Guarantee The Weather – But You CAN Insure It!

Many southern Maine jewelry store customers were hoping for snow on Christmas Day. Why? A local jeweler ran a well-advertised promotion promising free jewelry if it snowed on December 25. How can they afford to take that chance? We don’t know for sure, but we hope they consulted their local Maine insurance agent. While our agency had nothing to do with this promotion, we have helped clients reduce their risk by selling them weather insurance for special sales or events.

Can a Business Insure Against Bad Weather?

You bet! Let’s say your business plans an open house or a big one-day sale. You advertise heavily for 2 weeks before. You buy extra inventory, and add extra staff to take care of demand. But, a heavy snow storm keeps your potential customers at home, and you lose a lot of money. Or, you could buy a weather insurance policy to help recoup part of those costs, and cut your loss.

Can a Business Insure Against a Rainy Summer – or a Warm Winter?

What if your minor league baseball team suffers through a rainy summer? Or your tubing hill business encounters a warm, dry winter? Your organization might lose all sorts of same-day revenues: walk-up tickets; concessions; parking income, and more. A customized weather policy might pay a set amount if more than a certain number of game days have a specified amount of rain. A snow-area business could insure a mild winter in the same way, thereby stabilizing their income.

How Does Weather Insurance Work?

Like a good news article, weather insurance addresses the 4 W’s: What, When, Where and Who. As long as the event is measurable and the terms are specific, it can be insured. The price depends upon the terms. For example, if 6 inches of snow fall at a specific address in Portland, ME between 12:01 am and 11:50 pm on December 25 as measured by the National Weather Service, the insurer pays an agreed amount or percent of a pre-determined period sales. Decrease the number of inches and you’ll pay more premium; shorten the sale period, you’ll pay less.

Fifteen Businesses That Might Buy Weather Insurance:

- Florists and Nurseries – for big pre-season open house or important Spring and Fall weekends.

- Candy Stores – The last few days before Valentines Day are key!

- Golf courses – Insure against late snowstorms that can put a season on hold.

- Baseball teams – Rainouts mean lost revenue.

- Farmers’ Markets – Ever notice that it seems to rain EVERY Thursday?

- Snowmobile dealers – Reduce the risk of overbuying inventory in a dry winter.

- Ski resorts – It’s tough to make snow when in 40 degree weather. Even out budgeted revenue projections by insuring against warm weather.

- Tour companies – It’s a short season already. One rainy month can cause disaster.

- Car washes – Although I always seem to wash my car right BEFORE it rains, very few of us actually wash them WHILE it’s raining. A summer of rainy weekends means business lost forever.

- Jewelers or Car Dealers – High-ticket items are perfect for attention-getting giveaway promotions.

- Hotels & Motels – To level out income fluctuations when reservations are canceled due to weather.

- Festivals and Events – They’re expensive to put on, and it’s often tough to have a successful “rain date”.

- Beach parking lots

- Film Production Companies

The possibilities are almost endless.

Where Can You Buy Business Weather Insurance?

Several online options offer “self-service” weather insurance. Being a Maine independent insurance agency, we recommend using the services of an agent or broker. It costs exactly the same. A Maine business insurance expert can help you determine your needs and work within your budget. They can also help you evaluate the market, to assure that the insurance company is reputable and financially secure. And, they can help you if you need to file a claim.

For more information about business weather insurance, contact Noyes Hall & Allen Insurance at 207-799-5541.