After a few mild years, Maine is in the middle of an “old-fashioned winter”, which means plenty of snow and cold temperatures. Our Maine insurance agency is prepared for homeowners insurance claims for damage caused by frozen pipes, weight of snow, and ice dams.

What is an Ice Dam?

If you have icicles hanging from your roof, there’s probably an ice dam behind them. An ice dam is a ridge of ice that builds at the edge of a roof which prevents melting snow from draining off the roof. The melting snow above feeds the dam below. Draining water backs up behind the dammed ice. It flows into your attic through cracks and openings in your roof covering. From the attic it flows into your home, damaging walls, insulation and ceilings.

If you have icicles hanging from your roof, there’s probably an ice dam behind them. An ice dam is a ridge of ice that builds at the edge of a roof which prevents melting snow from draining off the roof. The melting snow above feeds the dam below. Draining water backs up behind the dammed ice. It flows into your attic through cracks and openings in your roof covering. From the attic it flows into your home, damaging walls, insulation and ceilings.

How to Prevent Ice Dams

Differences in temperature of various areas of your roof cause ice dams. The best prevention is a combination of insulation and ventilation. A well-ventilated attic keeps cold air circulating, maintaining a constant temperature. Proper insulation keeps the warm air in your home, allowing the ventilation to do its job.

Remove snow from the lowest 5′ of your roof with a snow rake if possible. Leave 2-3 inches of snow on the roof to prevent shingle damage. It’s safest to work from the ground. If you must get on a ladder, have someone to “spot” you. Make sure your ladder is on secure footing, and stay away from electrical lines.

How to Remove an Ice Dam

Removing an ice dam is delicate and dangerous work. You should not attempt it yourself unless you are physically capable. You can damage your roof or injure yourself if you do it improperly.

Removing an ice dam is delicate and dangerous work. You should not attempt it yourself unless you are physically capable. You can damage your roof or injure yourself if you do it improperly.

- Remove snow from your roof. If you DIY, use a “roof rake” and a push broom. If not, plenty of local contractors are available to do this for you.

- If water is flowing into your home, you can ease the flow by making a channel through the dam with warm water. DO NOT use a sharp object to break the dam. You will damage your roof!

- Some people use a thawing agent to help melt the dam. Some put the melting agent in nylon netting (womens’ hosiery in a pinch) to hold it in place over the dam. Others recommend against this, saying that it can damage shingles.

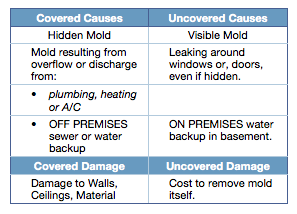

Does Homeowners Insurance Cover Ice Dams?

Many Maine homeowners policies cover interior water damage caused by ice dams. Typically not covered are the cost to remove the dam.

Ice dams do not usually damage a roof that’s in good condition. Once the ice melts, the shingles lay back down. If your shingles were in good condition, and ice damages them, your policy might pay to replace them. Policies and conditions vary. Check with your agent or insurance company to be sure.

For answers to your questions about Maine homeowners insurance or Maine business property insurance , call 207-799-5541. Your personal or business insurance agent at Noyes Hall & Allen is ready to help.