After the recent rash of water main breaks in South Portland Maine, many locals wonder if their Maine business insurance policy or Maine homeowners insurance covers water damage from such an occurrence. Here are some answers, depending on what kind of Maine insurance policy you purchased.

Is the Water District Responsible for Broken Water Mains?

In general, Maine public utilities are not considered liable except in cases of negligence. If they were repairing a main and forgot to shut off the water before disconnecting, causing a flood, you might have recourse. If the break is caused by an unforeseen circumstance, wear & tear, etc., you are probably on your own to repair the damage.

Basic Insurance Policies

Off-the-shelf Maine business property insurance policies do not cover water backup or flood damage. Neither do basic Maine homeowners, renters or condominium policies. While most do cover damage from leaking, freezing, or breaking of plumbing fixtures and appliances on the premises, damage from water that comes from the ground or under the ground is excluded. The two most common coverages that you can purchase are Water Backup Coverage , Underground Line Insurance Coverage and Flood Insurance.

Water Backup Insurance Coverage

Maine businesses and residents can purchase an endorsement to their property insurance policy that covers backup of sewers and drains. Water backup insurance is relatively inexpensive, because it only covers damage from water that backs up into your building. Damage from surface water or seepage through a foundation are not covered. If the water main break caused your drain to overflow, backing water into your building, you may have coverage. Unfortunately, that’s not usually what happens with a water main break. Usually, the water bubbles to the surface and inundates an area. To get coverage for that, you need to buy flood insurance.

Underground Line Insurance

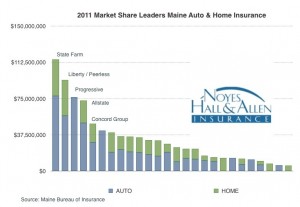

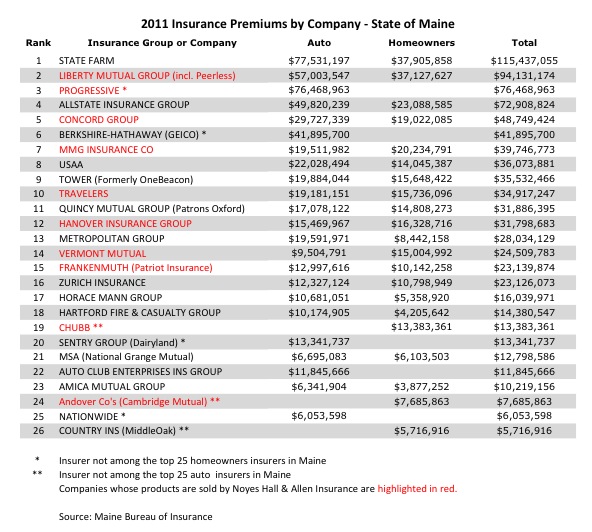

Some Maine insurance companies now offer underground service line coverage. They have a coverage limit – often $10,000, with a $500 deductible. Insurers now selling this coverage in Maine include Andover Companies, Concord Group and Vermont Mutual. Some sell the coverage a la carte, while others include it in a special bundle of coverage. In all cases, you have to purchase it – it’s not automatically covered by homeowners policies.

Related Post:

More Maine Home Insurers Cover Water & Sewer Lines

Flood Insurance in Maine

Only a small percentage of residents and businesses in Greater Portland purchase Maine Flood Insurance. That’s unfortunate. They think that because they’re not in an area that susceptible to flooding, they’ll take their chances. Maybe they never even thought about buying flood insurance. But, many events can cause a flood, from heavy rains to hurricanes to snowmelt.

To be defined as a flood, surface water must cover area that is normally dry land. If that area is more than 2 acres, or at least 2 contiguous property parcels are affected (including yours), you have experienced a flood. The only way to buy flood insurance is to buy a special flood policy (except for specially policies generally reserved for large corporations and commercial projects). Flood insurance policies exclude damage from water than seeps or leaks onto your property, unless a flood was the proximate cause of the leak.

If your home or business is in southern Maine, we would be happy to answer your questions about insuring your property. We have provided Maine business property insurance and personal insurance services to the Portland Maine area for more than 75 years. Contact a Noyes Hall & Allen Insurance agent at 207-799-5541.