You may have heard stories of people whose auto insurance went up after an accident that they say wasn’t their fault. In some cases, the other driver’s insurance company even paid for the damage to their car. Do insurance companies really do that? Is that legal? Is it ethical?

Is It Legal for My Insurance Company to Charge Me When the Accident Wasn’t My Fault?

The Maine Bureau of Insurance does allow auto insurance companies to charge for not-at-fault accidents. How does that happen? Insurance companies must file rate requests with the Bureau of Insurance. The Bureau requires insurers to show that the proposed rates are adequate, not excessive, and not unfairly discriminatory. They must prove that with data. Some insurers have apparently successfully proven to the Bureau that people who’ve been involved in accidents – even if they’re not at fault – are a higher risk than those who haven’t. Insurance companies are very protective of their proprietary data. We haven’t seen any of that documentation.

Does Every Maine Auto Insurance Company Charge for Not-At-Fault Accidents?

No. Of the nine major auto insurance companies in our agency, 6 charge for not-at-fault accidents; 3 do not. Just a few years ago, none of the insurance companies we represent did. It’s hard to say whether the three that don’t charge will start to do that for competitive reasons. But, for now, those 3 insurers may have a public relations advantage with consumers who feel that it’s unfair to surcharge for a not-at-fault accident.

Why Would I Do Business With an Auto Insurance Company That Charges Me for a Not-At-Fault Accident?

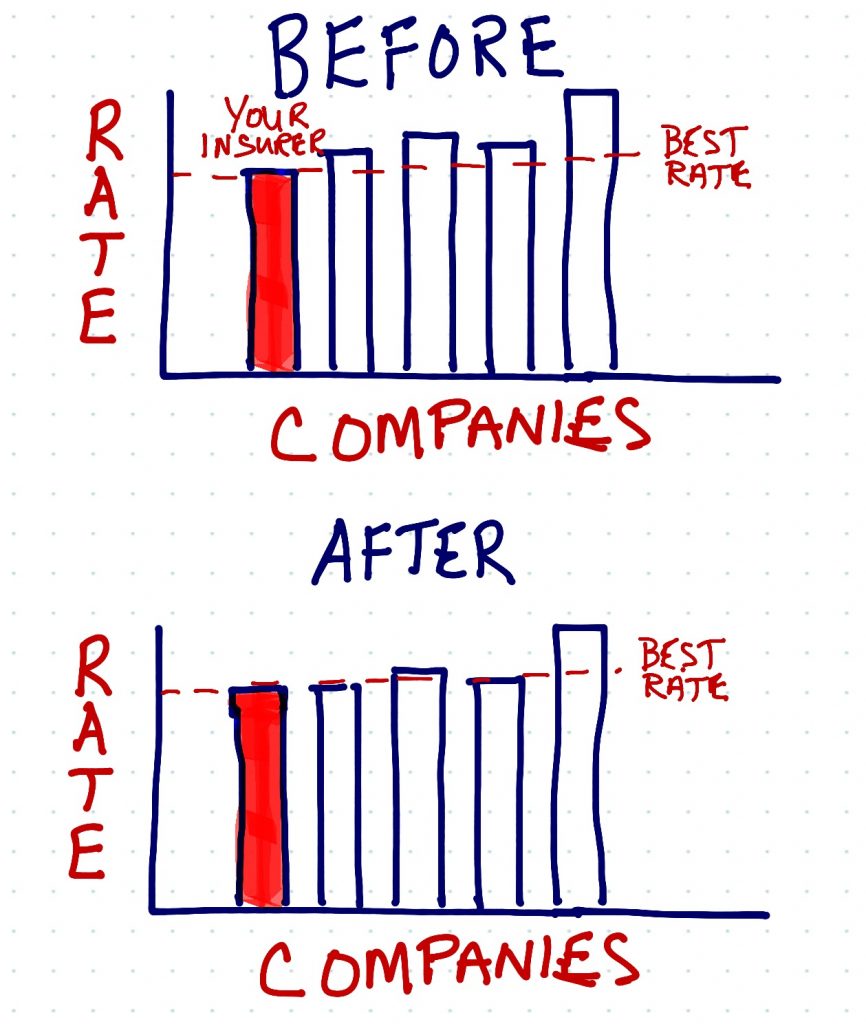

Even though your insurance company surcharges you for an not-at-fault accident, they may still have the best rates. How could that happen?

Let’s assume that your insurance company’s experience shows that people who’ve never had any kind of accident – at-fault or not – are much lower risks: 15% less likely to have a claim. Your insurance company wants to attract as many of these drivers as they can. So they file special rates for these folks 15% less than any other insurer, and expect to still make a profit. At the same time, they file a 15% surcharge for not-at-fault accidents. Even if you get a surcharge, you’re still paying no more than you would with any other insurer.

Is It Fair to Charge for Not-at-Fault Accidents?

We understand your outrage. You’re paying more for insurance just because you were in the wrong place at the wrong time. It’s bad enough that you were inconvenienced or hurt because of the crash. Surcharging your insurance policy afterwards adds insult to injury.

Some states, including California and Oklahoma, have refused to allow the surcharges. But the Maine Bureau of Insurance thinks it’s fair for insurers to charge for not-at-fault accidents. Many other insurance regulators do, too.

Are You Paying More Than You Should For Maine Auto Insurance?

Here’s one way to find out. If you live in Southern Maine, contact a Noyes Hall & Allen Insurance agent at 207-799-5541 for a no-obligation review. We will review your situation and present you with the best fit we have available. If your current insurance is the best deal, we’ll let you know. If we have something better, we can work with you to change if you want to.

Not ready to speak to a human yet? You can compare up to 6 insurance companies on our web site. If one of them looks good, you can let us know.