You’re stopped at a traffic light in South Portland, a stop sign in Portland or highway exit ramp in Falmouth, when suddenly – WHAM! a vehicle hits you from behind. You’ve been rear-ended. What should you do next?

In Maine, You’re Not Considered at Fault if You’re Rear-Ended

Every Maine driver is expected to operate their vehicle under control. That means being able to avoid an obstacle in the road ahead. If you’re following the rules of the road and stopped in traffic, waiting to make a turn, or just stopped, drivers behind you should be able to stop, go around you safely, or pay the consequences, regardless of road conditions. If it’s snowy or icy or rainy, they should allow extra time and distance, and be extra cautious.

Make Sure Everyone’s OK

First things first. Check on people before property. Is everyone in your vehicle OK? If it’s safe to get out of your vehicle, check on occupants of other vehicles involved. If there’s even the slightest injury (a bump, bruise – anything), call 911.

Check for Vehicle Damage

If it’s safe, get out of your vehicle and check the damage to all vehicles. Leave the vehicles where they are unless it’s completely unsafe. If you see ANY damage at all – no matter how minor it looks – we recommend that you…

CALL 911

Technically, Maine police only respond to accidents on public roads with bodily injury or combined property damage over $1,000. We recommend calling 911 even if you think there’s less than that, for 3 reasons:

- It takes nothing to cause $1,000 damage to a vehicle. Even a bumpers cost more than that, with all the technology modern bumpers contain (airbag sensors, rear cameras, etc.). Also, modern bumpers are designed to be part of “crumple zones”. What may look like a cracked bumper often masks greater damage underneath. Police (and drivers) are notorious for underestimating the cost of damages.

- The police will get the proper information. You’re stressed. Even if you trade information with the other driver, you’re likely to forget something that will be important to the insurance company.

- Stories can change. People are much less likely to change a story they told the police at the scene – a story that’s now part of a written report. In our Portland area insurance agency, we hear it often: injuries “appear” in days after the accident; someone who admitted fault at the scene later says it was YOUR fault; insurance information is revealed to be incorrect or fabricated. Having the police take the report makes these situations less likely.

While You Wait for the Police, Get the Other Party’s Information

Whether or not you take our advice to call 911, at least get the other driver’s:

- Name, address, and phone number

- Driver’s license number (make sure the addresses match the one they gave you)

- License plate number, and year, make & model of their vehicle (their registration will have this info).

This is important! Very often, the police gather this info but will not give this information to you at the scene. Instead, they give you a “report number”, and tell you the insurance company can call for that info. The problem is that those reports can take days or weeks to be available. Meanwhile, you want to get your car fixed.

Tip: Take pictures of these documents with your cell phone.

Report Your Accident to Insurance

In the case of a not-at-fault accident, call your agent, not your insurance company (you did buy from an agent, not one of those 800 numbers, didn’t you?) If you’re a client of ours, report your claim to Noyes Hall & Allen.

Armed with the proper information about the other driver and their insurance, we can do what your insurance company cannot do:

- Help you verify that their insurance is valid;

- Start the claim with that company.

- Advise you whether to file a claim on your own policy, depending upon your circumstances.

Who Pays to Fix Your Vehicle?

If the at-fault party has valid insurance, their policy should pay these costs:

- Repair your vehicle;

- Rent a comparable replacement vehicle while yours is unable to be driven;

- Medical expenses for anyone in your vehicle (some companies will make you collect from your own Medical Payments coverage first, and reimburse your insurance company).

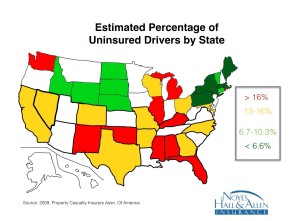

Not everyone has valid insurance. Just because the other driver has an insurance card in their glove box, that doesn’t mean that policy is in force. Even though it’s state law to have liability insurance, 5% of Maine drivers don’t. If the driver happens to be from out of state, that percentage might be as high as 25% (Mississippi). In that case, you’ll want to know what to do if you’re hit by somebody without insurance.

Should You Use Your Own Insurance?

Here’s why it’s better to have the at-fault party’s insurance pay for your damages.

- The claim stays off your insurance policy;

- You don’t have to pay the collision deductible;

- There’s no dollar or time limit for rental reimbursement.

Some insurance companies accept fault more quickly than others. Some situations are more cut-and-dry. The insurer is entitled to conduct their own investigation before accepting responsibility. Meanwhile, you may decide to put a claim under your own policy, pay the deductible, and move on.

If your insurer recovers the damages from the at-fault party’s insurer, they will reimburse the deductible to you, and wipe it off your insurance record. If they cannot collect, the accident will show as an “at fault” accident on your record, and you may pay higher rates in the future.

Each accident is different, and so is each person. Your independent insurance agent can provide personal advice and advocate for you. If you have questions about Portland Maine area auto insurance, or Maine commercial vehicle insurance, contact a Noyes Hall & Allen agent at 207-799-5541.

If you have “other than collision” coverage on your vehicle, water damage from flooding is covered. Other Than Collision coverage was formerly known as “comprehensive” coverage. If your car was inundated and needed to be towed to a mechanic for evaluation and repair, the towing would be covered, even if you didn’t purchase separate “towing” coverage. Of course, your deductible (usually $250 to $1,000) would apply.

If you have “other than collision” coverage on your vehicle, water damage from flooding is covered. Other Than Collision coverage was formerly known as “comprehensive” coverage. If your car was inundated and needed to be towed to a mechanic for evaluation and repair, the towing would be covered, even if you didn’t purchase separate “towing” coverage. Of course, your deductible (usually $250 to $1,000) would apply.