If you’ve made the decision to buy your first home or condo, congratulations! Although it’s a big, sometimes scary step, home ownership remains one of the smartest long-term decisions you can make if you plan to remain in the area for some time.

If you haven’t discovered it already, you’ll have a long “to-do” list prior to your closing, and plenty of advice from friends and strangers alike. Insuring your new home may merely be another item to check off your list. Unfortunately, that can lead to common mistakes which can easily be avoided. As a Maine insurance agency, we’ve seen most of them before:

1. Satisfying the Bank

Your lender requires proof of “hazard insurance” before closing to protect their asset – not yours. They’re happy as long as your insurance covers the amount of your mortgage. The problem is, you may be buying too much insurance – or not enough. A good insurance agent (may we suggest Noyes Hall & Allen?) will help you determine the amount of insurance necessary to rebuild your home, which is usually different than your mortgage amount.

2. Thinking Your Home is Your Largest Asset

You’re probably buying your home with a relatively small down-payment -likely less than 20% of the purchase price. You’ll make monthly payments over decades to repay your loan. Where will that money come from? Your future earnings, of course!

Your home isn’t your biggest asset; your future earnings are! How do you protect those?

- Liability insurance to protect your other assets – including future earnings – from judgement for legal damages, from someone slipping on the stairs to your dog biting a neighbor. Don’t cheap out on liability coverage when you buy your Maine homeowners insurance. It doesn’t cost much, but can make the difference between unfortunate occurrence and catastrophe. Talk to an agent you trust, and listen to their advice.

- Life insurance and disability insurance can replace your income if you or your co-borrower die or are unable to work prematurely. You don’t have to buy them before you buy your house, but most people either forget afterwards, or think that they can’t afford it later.

3. Thinking “Fire Insurance”

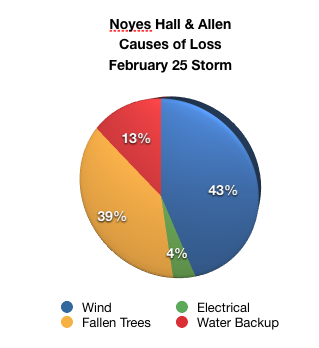

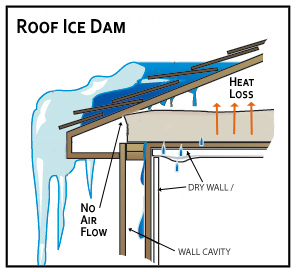

Fire isn’t the most common cause of damage to your home. Water is. We insure thousands of homes and condos. Fewer than 20 a year will experience a fire, but several dozen will experience water damage, theft or wind damage. An “off the shelf” homeowners policy doesn’t cover such common occurrences as water backup in the basement, a diamond falling out of its setting, or removal of fallen trees that don’t strike a building.

Don’t buy your insurance on price alone. Talk to an experienced local independent insurance agent about what’s covered – and what’s not.

4. Compartmentalizing

You have a lot on your plate when you’re buying a home, which can cause you to do the minimum amount of work to get each task done. That can cost you a lot of money.

Most insurance companies offer significant insurance discounts if they insure both your home and your car. This can save the average homeowner hundreds of dollars a year. Spend an extra 20 minutes to get a car insurance quote at the same time you get your home insurance.

Even better: contact a Trusted Choice® independent insurance agent, who represents several insurance companies. Let them do the shopping for you. If you’re in Southern Maine, Noyes Hall & Allen would be happy to provide this service.

5. Failing to Keep Up

Even if your insurance fits you like a glove when you buy your home, it can be like last year’s pants before you know it. Maybe you’ll acquire jewelry, expensive hobby or sports equipment, or start a small business from home. Maybe your kids will go off to college, or you’ll inherit something. All of these common life events can result in an uncovered insurance claim if you don’t have a regular conversation with your insurance agent.

All the more reason to buy your insurance locally from someone who’s likely to be there for the time you’ll own your home. Sound like anyone you know?

Any kind of wood-burning appliance causes concern for fire insurance companies. Insurers are often slow to adapt to new technology, since they rely on experience statistics to help them set rates and underwriting guidelines. However, most insurers understand the popularity of these stoves, and are trying to accomodate home owners who use them.

Any kind of wood-burning appliance causes concern for fire insurance companies. Insurers are often slow to adapt to new technology, since they rely on experience statistics to help them set rates and underwriting guidelines. However, most insurers understand the popularity of these stoves, and are trying to accomodate home owners who use them.