Did you buy home, condo or renters insurance from one company and auto insurance from another? You’re not alone. Maybe you bought a policy online to insure your first car. Then, when you bought your house or condo, you found a local agent who found you a good deal with another company. Each of your insurance companies has probably solicited you for the part they don’t insure.

Knowing that combining your home and auto insurance is smart is one thing; actually doing it is another. The good news is, it’s not that hard. Having separate insurance companies may not have hurt you too much so far. Sure, you might have paid a few dollars more, or put up with the hassle of multiple insurance bills, but you didn’t feel enough pain to motivate you to combine them.

That will likely change in 2012.

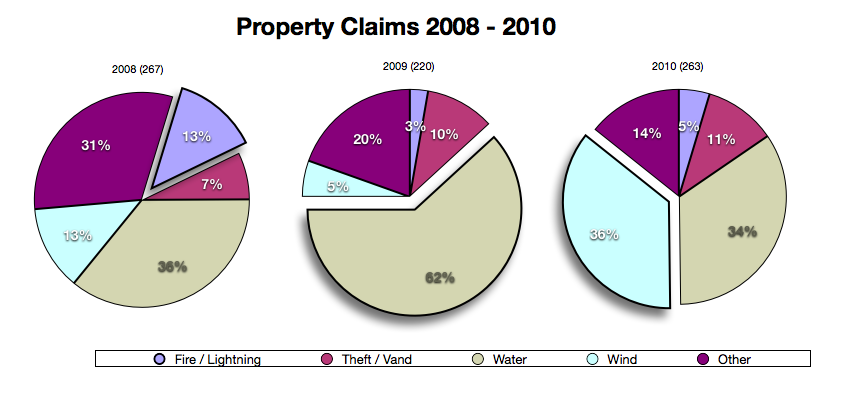

It’s only May, but 2012 has already brought big changes in Maine home and auto insurance. U.S. insurers have lost money on property insurance for several years in a row, due to natural disasters, broadened coverage, depressed pricing and increased reinsurance costs. With today’s low interest rates, insurance companies’ investment income is depressed as well. As a result, homeowners and Maine condo insurance prices are increasing significantly, and underwriters have become much more picky.

The single best personal property/casualty insurance move you can make right now?

Combine Your Property and Auto Insurance.

Here are 10 reasons why you should bundle your insurance today:

1) Save Hundreds of Dollars

Insurers are increasing the “package discount”, making it more attractive to insure your home and autos together. Many companies have increased the discount from 10% to 15%, 20% or even 30% discounts. This can save you hundreds of dollars a year.

2) Better Homeowners Rates and Coverage

Insurance underwriters (the people who choose whether to accept or reject your insurance application) have become VERY picky about home insurance. If you’re buying a home anywhere near the water, you might be quoted a premium nearly twice what the prior owner paid. You might also have a wind deductible of $5,000 or higher, when the prior owner had a $500 flat deductible. If you only insure your home with that company, you have no leverage with the underwriter. Bundling your coverage “sweetens the pot” for the insurance company, and levels the playing field a bit.

3) Avoid Non-Standard Insurance on Camp or Second Home

They don’t call Maine “Vacationland” for nothing. Maine has the highest ratio of secondary and seasonal homes to primary homes of any state in the US. Preferred insurance companies have willingly insured these homes for decades, even if they didn’t insure your primary home. In 2012’s tighter property underwriting environment, many insurers refuse to insure these properties unless they insure your primary home and auto. We still have access to insurers who will insure a Maine secondary or seasonal home; but, the rates are higher, and the terms less favorable than those of the preferred companies.

4) Reduced Risk of Non-Renewal

The more business you do with an insurance company, the more likely they will consider you a preferred customer. If you have multiple claims in a 3-year period, your name appears on an underwriter’s list of policies to review. Will they consider you “naughty” or “nice”? One factor they consider is the number of policies you have with the company. They’re more likely to cut some slack to a multi-policy customer than to one with a single policy.

5) Increased Convenience, Reduced Risk of Cancellation

If you have policies with different companies, you’re getting billed by each, and paying a billing charge to each. Most insurance companies can bill all of your policies in one bill. They call it “account billing”. It saves you money (billing fees and postage) and time, and reduces the chance of a late payment by at least 50%.

6) Preferred Umbrella Rates

Many financial advisors are shocked to find how little liability insurance many of their new clients have. Most advisors recommend that their clients buy a Maine personal umbrella policy, which provide liability insurance in excess of their home and auto insurance limits. Preferred umbrella insurers require that they insure all of the policies that their umbrella extends over (called “underlying policies”). We have access to companies that provide umbrella coverage without insuring all of your underlying policies, but they’re usually more expensive.

7) More Favorable Deductibles

Some insurance companies require a higher property deductible ($2,500 or more) if they don’t also insure your autos. They will allow a lower deductible if you have other policies with them.

8) Improved Service From Your Agent

An insurance agent’s worst nightmare isn’t losing you as a client; it’s seeing you suffer an uncovered loss that they could have helped you recover from. The more they insure for you, the better they can help you identify and close expensive coverage gaps.

Let’s say your company starts allowing you to work from home. You might tell your auto insurance company you’re no longer commuting, to get a break on your car insurance rates. But you might not think to tell your home insurance company. When your home is broken into and your work computer stolen, or when a business associate visiting your home slips and falls, you could be shocked to find that you have no coverage for that. If one company handles both, they have the full picture, and can better protect you.

9) Almost Free Renters Insurance

Most Portland Maine renters insurance policies start at about $100 a year. Most Maine car insurance policies are about $600 per year. If you get 15% off each by combining them, you’ve saved $105 a year – in essence getting your renters’ policy for free.

10) Smug Self-Satisfaction

Isn’t it satisfying to read one of these blog posts, and say “Already done that!” Yeah, we thought so.

If you would like a Maine auto insurance quote, or would like to discuss your insurance, contact a Noyes Hall & Allen agent at 207-799-5541.