A home is a place where you go after a long day of work. It is where you raise a family, and share and creates memories. To most people, home is the most important place and thus an investment. But life is unpredictable; you never know what to expect. You may wake up one day to find your house on fire or damaged by weather. What do you do then?

At Noyes Hall & Allen Insurance in Portland, ME, we are experienced and have been in the insurance business for quite some time, and within that time, we have had the chance to work with different clients and handle a multitude of different situations. We understand the risks that can affect a home, and so, we have various coverage options that are designed to fit your needs and provide the protection you want.

Here is a glimpse at some of the options available:

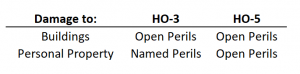

Structure Coverage

With our home insurance policy, we may be able to rebuild or repair your home if it gets damaged by hail, winds, fire, or any other disaster. Note, however, not all home insurance policies protect your home from floods, and so it is essential to make sure you know and understand your coverage.

Personal Belongings Coverage

Home is where you keep all your personal belongings. It is where you have your clothes, shoes, furniture, electronics, and just about everything in between. So, if your home is destroyed, all your possessions may become destroyed as well. With a personal belonging coverage, we help you recover all your lost or damaged personal items. It is also wise to make an inventory of your more important items for the insurance company.

Additional Coverage

If your home is destroyed, you may have to find a place to live while your home is being repaired. Noyes Hall & Allen Insurance can cover all additional living expenses which include restaurant and food bills. With that, you get to continue living your life without worrying about the costs.

If you are in the Portland, ME area, please feel free to contact us for more information and to have your questions answered.