First Winter as a Maine Homeowner? Avoid the “Big 3” Headaches

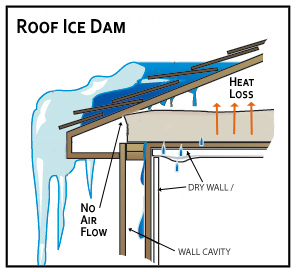

A quick bit of home maintenance this fall can prevent the headache of ice dams this winter. For more information about Maine homeowners insurance, call Noyes Hall & Allen at 207-799-5541.

Pellet stoves are hot. Over 50% of stoves bought in the U.S. in 2008 were pellet-fueled, according to the Pellet Fuels Institute.

Any kind of wood-burning appliance causes concern for fire insurance companies. Insurers are often slow to adapt to new technology, since they rely on experience statistics to help them set rates and underwriting guidelines. However, most insurers understand the popularity of these stoves, and are trying to accomodate home owners who use them.

Any kind of wood-burning appliance causes concern for fire insurance companies. Insurers are often slow to adapt to new technology, since they rely on experience statistics to help them set rates and underwriting guidelines. However, most insurers understand the popularity of these stoves, and are trying to accomodate home owners who use them.

Operated and maintained properly, well-built stoves can be a safe, economical way to heat your home. If you buy one, your insurance company will probably ask some questions about it. Here are some of the insurance company guidelines we’ve seen.

5 Keys to Making Your Pellet Stove Insurable

It’s always smart to ask your agent or insurance company before installing a wood-burning appliance. If you have any questions, contact Noyes Hall & Allen Insurance .

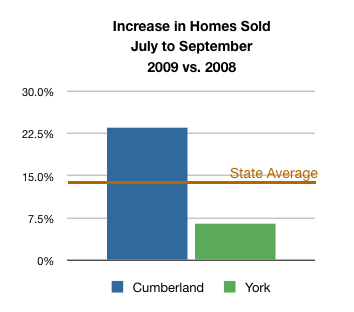

The number of Maine homes sold increased by 22.74% in September compared to the same month last year, the Maine Association of Realtors reported last week. While the Median Sales Price declined 6%, prices seem to be rebounding a bit. The decline in Median Sales Price indicates that homes in lower price ranges were moving faster than larger, more expensive homes. This is likely due to the influx of first time homebuyers responding to the government stimulus rebate program.

September’s results were the best of the quarter. From July through September 2009, 14.7% more homes sold compared to 2008, with the Median Sales Price 9.6% lower than last year. Cumberland County performed slightly better; 23.55% more homes sold this year, with a 6.1% drop in Median Sales Price.

First Time Home Buyers Must Act Soon!

Realtors report that first time homebuyers are driving the market, aided by government stimulus tax credits. Unless extended, this program will expire soon. Home sales must close before November 30 to qualify for the plan.

In our South Portland insurance agency, we’ve seen a similar trend. Many of the homeowners insurance quotes we’ve delivered this summer were for first time homebuyers. We take extra time to help the new home owner understand homeowners insurance, closing costs and escrow procedures. We also work with lenders to make sure that there are no surprises at closing. Contact Noyes Hall & Allen Insurance for a no-obligation consultation: 207-799-5541.

Download the Maine Association of Realtors’ press release.

Mainers who own homes near the coast – even as far as a mile from the shore – are having a harder time finding homeowners insurance. Despite a quiet Atlantic hurricane season so far this year, Insurers are acting on more dire long-term hurricane predictions and historically poor loss history on the East Coast.

Most insurers are reducing their appetite for insuring coastal homes. Some are refusing to insure homes within a mile of the coast, even for customers they’ve insured for years with prior homes. Those companies that do insure coastal property may require higher deductibles or charge higher rates than in prior years.

At Noyes Hall & Allen Insurance, we’re fortunate to represent many insurers, and have access to many more. We still have preferred options available for coastal homes if it’s your primary home. If your homeowners insurance premium or deductible increase has gotten your attention, or if you’re buying a new home near the coast and finding insurance problems, call us at 207-799-5541 or find live support on our web site .

Secondary and seasonal homes on the coast are more difficult to insure. We recommend that you contact the insurer of your primary residence to see what options they might have available for your vacation home. Otherwise, your insurance options will likely be limited. The pricing and coverage terms will probably be less than desirable.

If you’ve made the decision to buy your first home or condo, congratulations! Although it’s a big, sometimes scary step, home ownership remains one of the smartest long-term decisions you can make if you plan to remain in the area for some time.

If you haven’t discovered it already, you’ll have a long “to-do” list prior to your closing, and plenty of advice from friends and strangers alike. Insuring your new home may merely be another item to check off your list. Unfortunately, that can lead to common mistakes which can easily be avoided. As a Maine insurance agency, we’ve seen most of them before:

1. Satisfying the Bank

Your lender requires proof of “hazard insurance” before closing to protect their asset – not yours. They’re happy as long as your insurance covers the amount of your mortgage. The problem is, you may be buying too much insurance – or not enough. A good insurance agent (may we suggest Noyes Hall & Allen?) will help you determine the amount of insurance necessary to rebuild your home, which is usually different than your mortgage amount.

2. Thinking Your Home is Your Largest Asset

You’re probably buying your home with a relatively small down-payment -likely less than 20% of the purchase price. You’ll make monthly payments over decades to repay your loan. Where will that money come from? Your future earnings, of course!

Your home isn’t your biggest asset; your future earnings are! How do you protect those?

3. Thinking “Fire Insurance”

Fire isn’t the most common cause of damage to your home. Water is. We insure thousands of homes and condos. Fewer than 20 a year will experience a fire, but several dozen will experience water damage, theft or wind damage. An “off the shelf” homeowners policy doesn’t cover such common occurrences as water backup in the basement, a diamond falling out of its setting, or removal of fallen trees that don’t strike a building.

Don’t buy your insurance on price alone. Talk to an experienced local independent insurance agent about what’s covered – and what’s not.

4. Compartmentalizing

You have a lot on your plate when you’re buying a home, which can cause you to do the minimum amount of work to get each task done. That can cost you a lot of money.

Most insurance companies offer significant insurance discounts if they insure both your home and your car. This can save the average homeowner hundreds of dollars a year. Spend an extra 20 minutes to get a car insurance quote at the same time you get your home insurance.

Even better: contact a Trusted Choice® independent insurance agent, who represents several insurance companies. Let them do the shopping for you. If you’re in Southern Maine, Noyes Hall & Allen would be happy to provide this service.

5. Failing to Keep Up

Even if your insurance fits you like a glove when you buy your home, it can be like last year’s pants before you know it. Maybe you’ll acquire jewelry, expensive hobby or sports equipment, or start a small business from home. Maybe your kids will go off to college, or you’ll inherit something. All of these common life events can result in an uncovered insurance claim if you don’t have a regular conversation with your insurance agent.

All the more reason to buy your insurance locally from someone who’s likely to be there for the time you’ll own your home. Sound like anyone you know?

Beginning November 1, 2009, a new Maine law requires smoke detectors and carbon monoxide detectors in every rental property, and in any residence purchased after that date.

As always, insurance companies will allow Homeowners insurance discounts for smoke detectors and other protective devices.

Detectors Required

- Must be 120V with battery backup and powered by the building’s electrical system.

- Plug in units are acceptable, as long as they have a battery backup.

- Detectors must be in each unit, near bedrooms for apartments or rental homes – even seasonal or occasional rentals.

- Must be photo-electric type if located within 20′ of a kitchen or bathroom.

Buying a Home?

Buyers (not sellers) must certify that these detectors are in the property in order to close on a purchase & sale agreement. The Maine Dept. of Public Safety is drafting a certification form which will be used for this purpose.

For more information:

As another school year begins, our clients who are parents of middle school students are asking us about insuring the laptop computers issued through the Maine Learning Technology Initiative. As a Maine insurance agency, Our understanding is that the State does not have a “blanket” insurance program; however, many school departments appear to offer separate insurance coverage.

In general, we recommend that our clients buy the coverage through their child’s school. Here’s why:

Each school insurance program has restrictions; for example, some prohibit taking the computer out of Maine. Be sure to read yours before choosing how best to protect your child’s computer. For more information, contact us at Noyes Hall & Allen at 799-5541.

As the Press Herald reported in this September 5 story, FEMA is updating its current flood hazard maps for much of the southern Maine coast. These maps are used to determine insurance costs in the National Flood Insurance Program (NFIP), the only flood insurance available for most properties. Maine business property insurance, homeowners insurance and condo insurance do NOT cover flood damage.

FEMA proposes to change the zoning of much waterfront property in South Portland, Portland and Cape Elizabeth. The cities of Portland and South Portland are challenging the new zoning, but there’s no guarantee that they will be successful.

The Zone Differences

FEMA’s zone classification system defines an area that has a 1 percent chance of being inundated by flood waters in a given year a “special hazard area”. There are two categories of “special flood hazard areas”, “A” and “V”.

The difference is that “A” zones are low-lying areas subject to flooding, while in “V” (velocity) zones, the water is more likely to flow with the increased hazard and damage of wave action. Many of the proposed changes would switch local oceanfront property from an “A” zone to a “V” zone; some may extend “A” zones to properties not previously considered to be in a “special hazard zone”.

How This May Effect You

Compared to properties not in a “special hazard zone”, Properties in an “A” zone:

In addition to these conditions, properties in a “V” zone:

What You Can Do

View local flood maps at your local planning office.

If your property is proposed to be re-located into either an “A” or “V” zone, call your insurance agent immediately. Since the maps are not yet effective, property owners can take advantage of cost-saving options that allow them to “lock in” at their current zone. Depending on your property’s value and location, this could save you thousands of dollars per year.

For more information, contact Noyes Hall & Allen Insurance at 799-5541, or the FEMA Map Assistance Center at 877-336-2627.

* * * UPDATE * * *

The Portland Press Herald reported on September 21 that FEMA is delaying implementation of the new flood maps, and will re-start the appeal process, likely in early November. The agency cited technical errors in the notification process, not any methodological errors, as the reason for the delay.

If your house is like mine, you have random piles of clothing, boxes of ramen noodles and bedding all over the place, waiting to load into the car for the annual college move-in. Ours moves in this weekend. Let’s hope the weather cooperates!

College is one of the biggest expenses we parents face in our lifetimes. With finances so tight, it’s certainly not the time to find out that your Maine auto insurance policy doesn’t cover an accident or theft isn’t covered by your Maine homeowners insurance. Here are a few common scenarios, and how the policies our Maine insurance agency sell respond. YOUR policy may be different.

Car Insurance

Even though it’s tempting to remove your children from your Maine auto insurance policy to save money, it’s a bad idea. They still need coverage for times when they’re home, or if they borrow someone else’s car. Hey, it happens.

For more information, contact your agent or company. Or, contact Noyes Hall & Allen Insurance at 207-799-5541. After all, we just gave you a bunch of free advice, didn’t we? And we’ve got kids to put through college too!