Conditional renewal occurs when your insurance company makes changes to your policy that you did not request. These changes can range from minor adjustments to significant alterations. It’s essential to understand what these changes mean for you..

When Do Insurers Use Conditional Renewal?

Insurance companies often change underwriting requirements. They often “grandfather” in-force policies from these changes. But sometimes conditions change dramatically. Then the insurance company decides to make wholesale changes, even to in-force policies. Or, the insurance company may take a specific action on your policy.

Common Conditional Renewal Types

These are the most common changes in a conditional renewal:

- Deductible changes – This could mean an increased deductible or the introduction of a new type, such as a separate wind or hurricane deductible.

- Liability Limits – Your liability insurance protection might be reduced, for example, from $500,000 to $100,000.

- Coverage exclusions or reductions – Certain coverages, like towing or roadside assistance, might be removed or reduced.

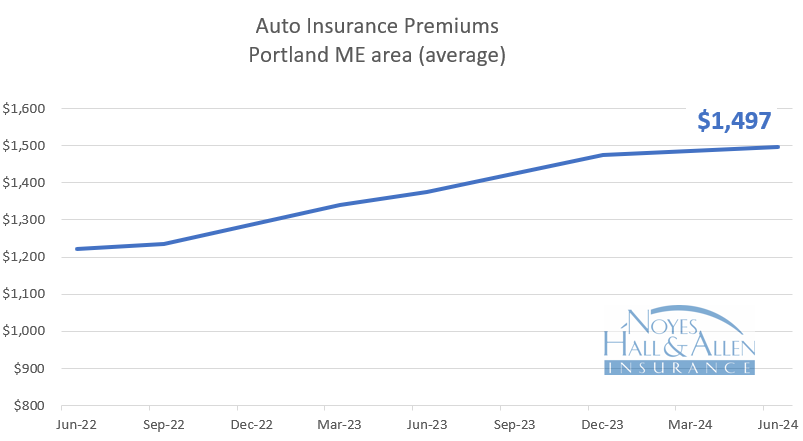

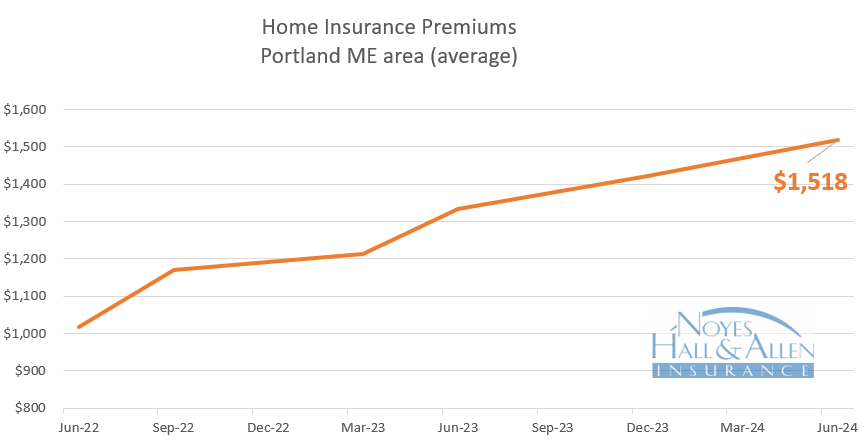

- Large rate increases – Some states require notification of significant price increases, though this is not the case in Maine.

Why Am I Getting a Conditional Renewal?

Your insurer might be implementing an across-the-board change, such as a new minimum deductible or a wind deductible for any property in a certain location.

Or the underwriter could be taking specific action on your policy. This is usually in response to claims or some condition that they’ve identified. In this kind of conditional renewal the notice will list the reasons.

Is the Insurance Company Canceling My Policy?

No, a conditional renewal is NOT a non-renewal. The insurance company is offering to renew your policy, however with different terms than before. On the other hand, if the insurance company mails you a Notice of Nonrenewal, they are terminating your contract.

Do I Have Options?

You’re not required to accept the conditional renewal, but it might still be the best deal for you. Conditional renewal is often a re-calibration to the market. In other words, your insurance company is doing what most new insurers would do.

However, you can check with your Noyes Hall & Allen agent to see what they think. We offer a choice of several insurance companies. That gives us good perspective on the market so that we can provide personal advice for your specific situation. We like to say we’re independent and committed to you.