Many southern Maine jewelry store customers were hoping for snow on Christmas Day. Why? A local jeweler ran a well-advertised promotion promising free jewelry if it snowed on December 25. How can they afford to take that chance? We don’t know for sure, but we hope they consulted their local Maine insurance agent. While our agency had nothing to do with this promotion, we have helped clients reduce their risk by selling them weather insurance for special sales or events.

Can a Business Insure Against Bad Weather?

You bet! Let’s say your business plans an open house or a big one-day sale. You advertise heavily for 2 weeks before. You buy extra inventory, and add extra staff to take care of demand. But, a heavy snow storm keeps your potential customers at home, and you lose a lot of money. Or, you could buy a weather insurance policy to help recoup part of those costs, and cut your loss.

Can a Business Insure Against a Rainy Summer – or a Warm Winter?

What if your minor league baseball team suffers through a rainy summer? Or your tubing hill business encounters a warm, dry winter? Your organization might lose all sorts of same-day revenues: walk-up tickets; concessions; parking income, and more. A customized weather policy might pay a set amount if more than a certain number of game days have a specified amount of rain. A snow-area business could insure a mild winter in the same way, thereby stabilizing their income.

How Does Weather Insurance Work?

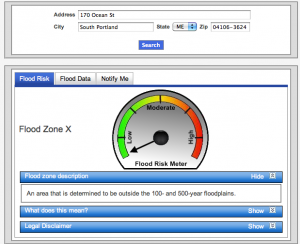

Like a good news article, weather insurance addresses the 4 W’s: What, When, Where and Who. As long as the event is measurable and the terms are specific, it can be insured. The price depends upon the terms. For example, if 6 inches of snow fall at a specific address in Portland, ME between 12:01 am and 11:50 pm on December 25 as measured by the National Weather Service, the insurer pays an agreed amount or percent of a pre-determined period sales. Decrease the number of inches and you’ll pay more premium; shorten the sale period, you’ll pay less.

Fifteen Businesses That Might Buy Weather Insurance:

- Florists and Nurseries – for big pre-season open house or important Spring and Fall weekends.

- Candy Stores – The last few days before Valentines Day are key!

- Golf courses – Insure against late snowstorms that can put a season on hold.

- Baseball teams – Rainouts mean lost revenue.

- Farmers’ Markets – Ever notice that it seems to rain EVERY Thursday?

- Snowmobile dealers – Reduce the risk of overbuying inventory in a dry winter.

- Ski resorts – It’s tough to make snow when in 40 degree weather. Even out budgeted revenue projections by insuring against warm weather.

- Tour companies – It’s a short season already. One rainy month can cause disaster.

- Car washes – Although I always seem to wash my car right BEFORE it rains, very few of us actually wash them WHILE it’s raining. A summer of rainy weekends means business lost forever.

- Jewelers or Car Dealers – High-ticket items are perfect for attention-getting giveaway promotions.

- Hotels & Motels – To level out income fluctuations when reservations are canceled due to weather.

- Festivals and Events – They’re expensive to put on, and it’s often tough to have a successful “rain date”.

- Beach parking lots

- Film Production Companies

The possibilities are almost endless.

Where Can You Buy Business Weather Insurance?

Several online options offer “self-service” weather insurance. Being a Maine independent insurance agency, we recommend using the services of an agent or broker. It costs exactly the same. A Maine business insurance expert can help you determine your needs and work within your budget. They can also help you evaluate the market, to assure that the insurance company is reputable and financially secure. And, they can help you if you need to file a claim.

For more information about business weather insurance, contact Noyes Hall & Allen Insurance at 207-799-5541.