There are many ways to compare auto, home, condo or renters insurance prices. Most people prefer to save time and work by getting several quotes at the same time.

Two common methods: contact a local independent agent; or get multiple quotes from an app or web site. Businesses that produce these quote sites are called “aggregators”.

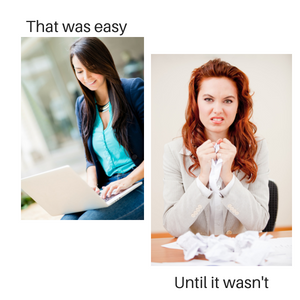

Online Insurance Sites & Apps: easy to use, but…

Online insurance shopping sites and apps are usually well-designed, easy and convenient to use.

Most don’t sound anything like an insurance company. They’re often named after a food or an animal, for some reason. Or they sound like tech companies.

That’s because most are not insurance companies. They’re really lead generators. And you’re the product they sell. Although insurance aggregators promise quotes, they rarely present firm numbers. Instead, they sell your information to insurance agents and companies. It’s up to those agents to try to close the sale.

And they’re relentless.

My Insurance Shopping Nightmare

My Insurance Shopping Nightmare

I tried getting quotes recently. I’d barely clicked “submit” when my phone started ringing. It didn’t stop for 2 days. My voice mail clearly says I’m an insurance agent. You’d think they would quickly figure out that I wasn’t going to buy from them. But they kept calling back. And the emails! I gave them credit for persistence even as I cursed their repeated interruptions.

Think that’s unusual? Google insurance quote scams.

Of course, not all insurance quote sites are the same. Some provide an estimated price at the end of your session. But most of those still need more information from you to produce a policy. That can change the price.

Independent Agents: good insurance takes time

Independent insurance agents also offer several insurance options at the same time. They are locally owned businesses. There are about 35,000 in the US.

Call or visit an IA and you’ll spend 10 minutes answering the questions they need to quote. Then, the agent compares rates and coverage and presents a recommendation.

Instead of just taking your order, good independent agents use their local market and insurance knowledge to recommend the right solution. It may take a bit more time than the aggregator’s app, but that can be a great investment if it helps you avoid an expensive mistake.

Some independent agents are more aggressive than others. Some even buy leads from aggregators. A few (like us) offer online insurance quotes 24/7 on their website. Most don’t share your personal information with anyone else.

It’s smart to shop your insurance

Savvy consumers know to compare insurance prices. You can call several “one company stores”; give your information to an online aggregator; or choose a local independent agent that you trust. If you’re in Southern Maine, Noyes Hall & Allen Insurance might be the agent you trust. Find out. Call us at 207-799-5541, get insurance quotes online, or stop by our South Portland office. We’re independent and committed to you.