Mold is nasty. It’s hazardous to health, hard to eradicate, and may be undetected for a long time. Even worse, Maine Homeowners Insurance policies provide very little protection against mold damage.

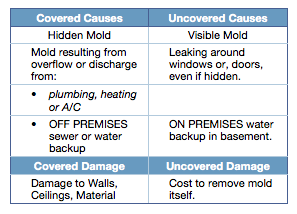

The standard homeowners policy excludes damage from mold, fungus and wet rot. Then, it gives back a small amount of coverage – often $5,000 – for mold damage in very limited cases. Even if the cause of the mold is covered, your policy excludes mold damage unless it was hidden. In other words, you shouldn’t expect much help from your home insurer. And, we know of no other insurance source either.

OUTLINE* OF MOLD COVERAGE UNDER

MAINE HOMEOWNERS POLICIES

Determining how an insurance policy responds – or doesn’t – to mold is tricky, even for experienced local insurance agents. It’s impossible to tell whether you’ll have coverage until an adjuster sees the damage. If you discover mold in your home, contact your local Maine insurance agency to discuss it. They can help you report an insurance claim to your insurer. They can also help explain your policy coverage and exclusions. An agent can also advocate for you if your claim is unfairly denied.

For answers to questions about your home, condo, or Maine business property, contact your agent at Noyes Hall & Allen Insurance at 207-799-5541.

_ _ _ _