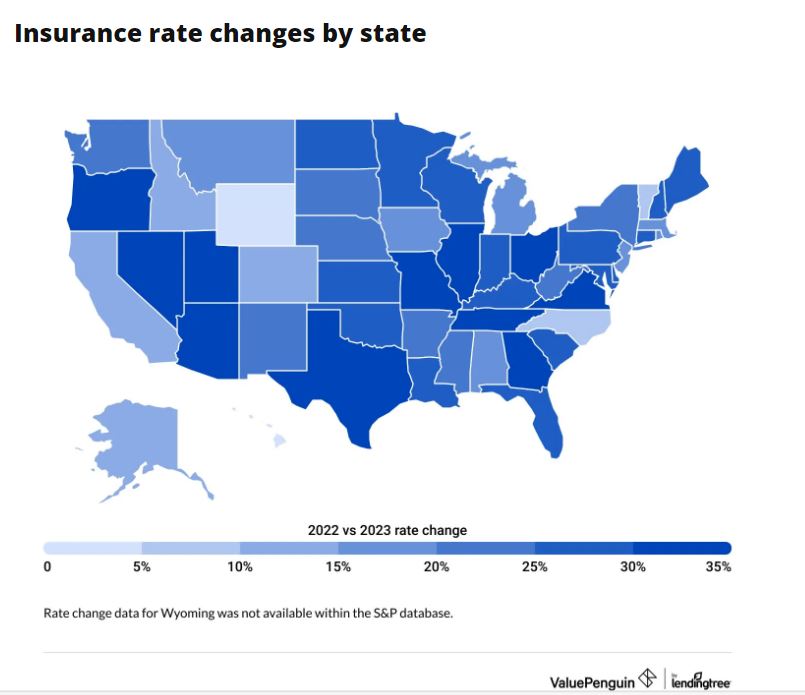

Maine insurance rates follow national and local trends and claim experience. Home and auto rates continue to rise as insurers and customers struggle with rising costs. Portland Maine area insurance buyers saw more than a 15% price increase in 2023. Industry experts expect this to continue in 2024. Still, Maine insurance rates remain among the lowest in the US.

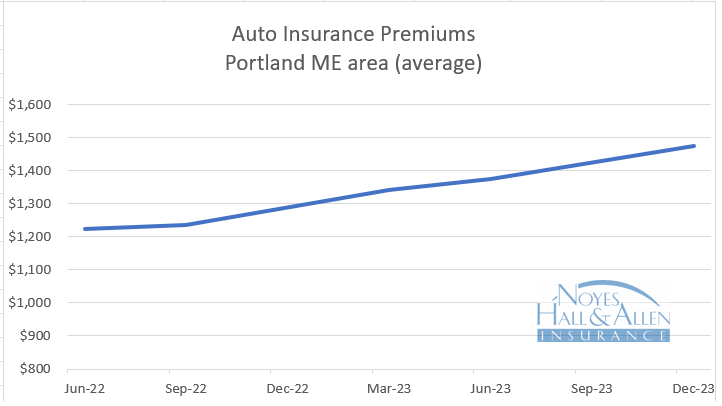

Maine Insurance Rates – December 2023 – Auto

Portland Maine area auto insurance rates jumped 14.4% on average in 2023. The average annual auto insurance policy in Cumberland County now costs $1475 per year.

According to a report by Insurify, personal auto prices were up 17% countrywide in the first half of 2023. The Bureau of Labor Statistics reported that auto insurance prices increased 20.3% in 2023. Maine rates increased even more: 28% statewide, according to Insurify. That was the 6th highest rate in the US.

Several factors put strong upward pressure on auto insurance rates everywhere in the US:

- Used auto prices are at an all-time high.

- New vehicles have much more technology, which makes parts more expensive to replace.

- Auto body shops are backlogged, increasing auto rental costs

- Auto parts and labor remain scarce, increasing prices

- Medical care inflation is high.

Will auto insurance rates level off in 2024? We don’t see any signs that they will. Neither does the financial advice site Motley Fool.

The good news is that Maine auto insurance rates are the lowest in the US according to the Value Penguin “State of Auto Insurance 2024” report. They report that the average Mainer pays $92 per month for car insurance, 44% less than the national average.

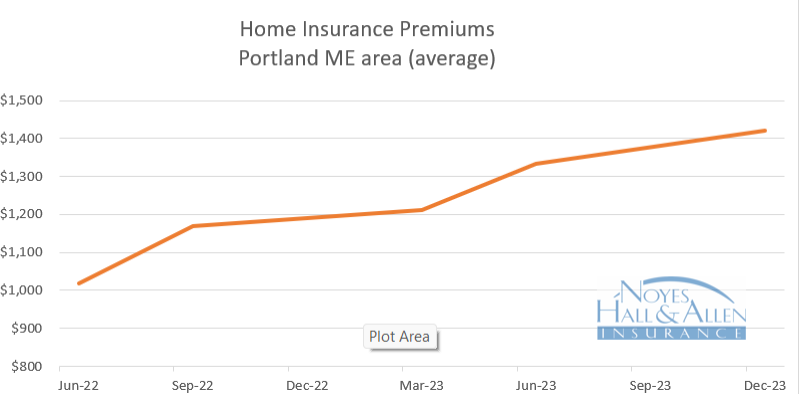

Maine Insurance Rates – December 2023 – Homeowners

Maine home insurance rate increases continue to outpace even large auto insurance increases. The average home insurance premium was 17.7% higher than a year ago. The end is not in sight yet, as US home insurers report record losses from weather events and historically high rebuilding costs.

Many of the same insurance inflationary factors described above affect home insurance. But reinsurance costs remain one of the biggest drivers of property insurance rates. Reinsurance is insurance for insurance companies. It protects them against catastrophic losses from natural disasters like wildfires, blizzards, ice storms, hurricanes and tornadoes. Many insurance companies continue to see their reinsurance costs jump 30-50% this year. Insurance companies pass on that cost to their customers.

Although this isn’t great news for Mainers, we’re better off than many areas of the country. Extreme weather has caused wildfires in the west and north, tornadoes and heat in the south and torrential rains elsewhere. Insurance companies have responded by canceling policies in Florida, Louisiana and California, and reducing their new policy offerings elsewhere.

We Remain Independent – and Committed to You

Most financial advisors recommend comparing to get the best insurance value. If you live in southern Maine, you can get up to 5 insurance quotes in 10 minutes from our website. Or contact a Noyes Hall & Allen agent in South Portland at 207-799-5541 for a free no-obligation custom review.

For more than 80 years, we’ve helped southern Mainers navigate the insurance market. While we don’t have any control over prices, we offer a choice of several insurance companies. That means we can help you find the best insurance value in any market.

We’re independent and committed to you.