When the blows hard many homeowners and business owners discover that their insurance policy has a wind deductible. Windstorm insurance deductibles have been common in the Southern US for years. In Maine, they’re more commonly found on insurance policies for coastal or island properties.

Not every insurance policy in Maine has a separate wind deductible. If your policy doesn’t list one, then your regular property deductible applies to wind damage.

Wind Deductible Amounts – Flat or Percentage

Most homeowners and business property policies have a flat deductible that applies to all causes of loss. These are fixed dollar deductibles. For example if your deductible is $1,000 it applies whether you have a break-in, fire, water or wind damage, you pay the first $1,000.

Many wind deductibles are “percentage deductibles“. The deductible is a percentage of the insurance amount, NOT the actual loss. For example, if your home is insured for $500,000 and has a 1% wind deductible, a $5,000 deductible applies to wind damage, and your flat deductible applies to other causes of loss.

Common Types of Windstorm Damage in Maine

- Wind blows a tree onto property, damaging it.

- Wind damages roof shingles or siding.

- Wind-driven rain lifts shingles and siding, allowing water into the building.

Three Types of Wind Deductible in Maine Insurance

- Hurricane deductibles

- “Named Storm” deductibles

- Wind deductibles

Hurricane Insurance Deductible

A hurricane deductible only applies if your wind damage was caused by an actual hurricane. If your property is damaged by wind during any other kind of storm, the deductible doesn’t apply. Insurance policies define when a hurricane deductible applies. Usually it’s during the time and place that a hurricane watch or warning is in effect.

“Named Storm” Insurance Deductible

“Named storms” include tropical storms and depressions, as well as hurricanes. These occur more frequently, so “named storm” insurance deductibles are more likely to be applied. A homeowner would rather have a hurricane deductible.

Historically, “named storms” were limited to tropical cyclones. But in recent years, the National Weather Service has begun naming winter storms. Does wind damage that occurs in one of these named winter storms cause the “named storm deductible” to apply? That’s unclear. In our South Portland Maine insurance agency, we haven’t heard of an insurance company invoking that. But, it could happen.

Wind Damage Insurance Deductible

Wind deductibles apply to all kinds of wind damage, including those caused by hurricanes, named storms, or other wind. Even moderate winds can cause damage to property. A homeowner or business owner would prefer a hurricane deductible or a named storm deductible to a wind deductible. That’s because windy days happen much more frequently than hurricanes.

Which Insurance Companies Use Wind Deductibles?

Some insurers use only hurricane deductibles. Others use Named Storm deductibles. Still more use wind deductibles. And some don’t use wind deductibles at all.

Each insurance company has its own guidelines. Some large national insurers use a wind deductible for any property within 1 or 2 miles of the coast. That’s a lot of homes in Maine. Many use special deductibles for properties within 1000′ of the coast.

The geography of Maine’s coast varies greatly. South of Portland, much of the coast is low-lying beaches open to the Atlantic. This allows ocean windstorms to affect properties farther from the shore. North of Portland, the coast is more rocky and rugged. Many elevated peninsulas create leeward inlets and protected harbors.

Some insurance companies that understand Maine underwrite these coastal areas differently. They may require a special deductible for properties more exposed to wind, and not for others.

Does Your Insurance Policy Have a Wind Deductible?

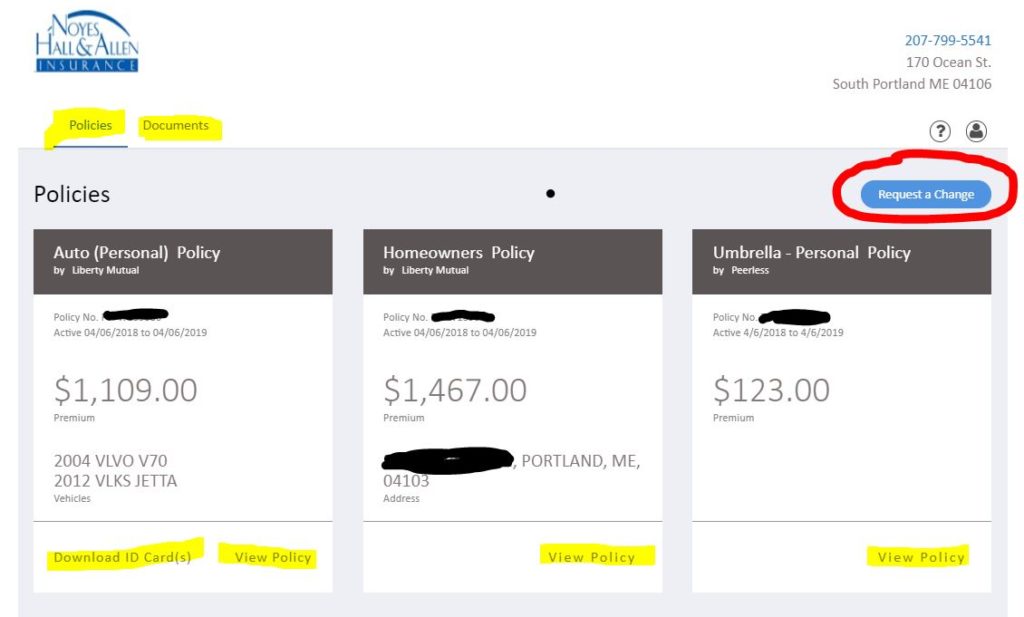

If your policy has a separate windstorm deductible, contact Noyes Hall & Allen Insurance in South Portland at 207-799-5541. We offer a choice of many of Maine’s preferred home and business insurance companies. Depending on the location of your home, we may find an insurer willing to insure your property with a flat deductible. This could save you thousands of dollars in case of windstorm damage.

Most Maine auto insurance companies allow you to “suspend” coverage once a year while your car is off the road. That means dropping liability, collision and all other coverage except comprehensive. Your vehicle would remain insured against theft, tree or animal damage and collapse of the garage. This greatly reduces the insurance costs for the storage months.

Most Maine auto insurance companies allow you to “suspend” coverage once a year while your car is off the road. That means dropping liability, collision and all other coverage except comprehensive. Your vehicle would remain insured against theft, tree or animal damage and collapse of the garage. This greatly reduces the insurance costs for the storage months.