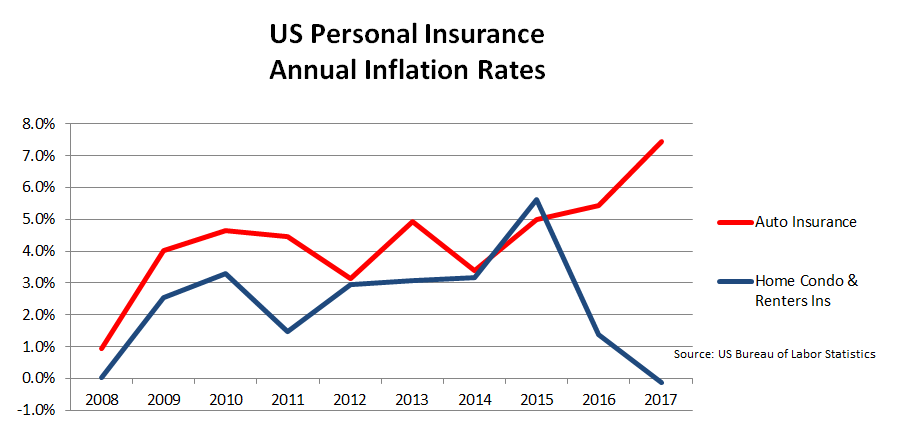

U.S. auto insurance rates increased 7.5% between January 2016 and January 2017. That’s after more than a 5% increase in 2006. What’s driving the increasing cost of car insurance? More accidents? More highway deaths? We hear about 4 major factors combining to make the cost of car insurance go up even faster than overall inflation.

Medical and Labor Costs

Insurance pays for two big expenses: auto repairs and medical expenses. Medical expense prices increased about 32% in the 8 years between 2005 and 2013. Auto repair labor costs have increased too. Also, it costs more to fix a newer car than an older one (see #3 below).

More Crowded Roads

Even if you aren’t driving more miles, your neighbors are. It’s not your imagination: the roads are more crowded. More cars on the road means an increased chance of a crash. Americans drove more that 3 trillion miles in 2015, a 3.5% increase from 2014. That’s the largest annual increase in 25 years. Why? Economists say an improving economy and low gas prices were the main reasons.

Lots of Newer, Hi-Tech Vehicles

Car makers are selling lots of vehicles. And many of them are computers on wheels. Americans bought 17.5 million new vehicles in 2015, a 5.7% increase from 2014. Newer cars cost more to fix than older ones. They also have advanced tech features. Rear bumper cameras are very common now. Front bumper radar and other safety features are available on many models. Even a side mirror likely has “blind spot warning” hardware. If you do get in an crash, chances are the insurance company will have to pay more to fix the other car than it would have a few years ago.

Distracted Driving

You may be the same safe driver you’ve always been. Unfortunately, many others on the road aren’t paying as much attention. A 2013 AAA study found that 2 out of 3 drivers reported using a mobile phone while driving. More than 25% admitted sending a text or email while behind the wheel. The National Safety Council estimates 26% of all car crashes involve cell phone use. Distracted driving increases the risk of a crash as much as driving drunk.

Related Post: Why Did My Maine Auto Insurance Go Up?

Should You Shop Your Maine Car Insurance?

Maybe. Every insurance company files their own rates based upon their experience and appetite. If your insurer had lots of claims in another part of the country, it could be affecting your rates. If you live in Southern Maine, contact a Noyes Hall & Allen Insurance agent for a review at 207-799-5541. We represent many different insurers, so you can compare with one phone call.

Not ready to talk to a human yet? You can still compare prices from up to 6 Maine auto insurance companies online on our web site.

When you chat with us, we can provide personalized, custom, professional advice. As a Trusted Choice insurance agent, we are independent and committed to you.