Recently, a very smart guy asked on Twitter:

“why does it cost $19 a year to reduce my deductible from $1,500 to $1,000, but I only save $25 a year to increase it from $1,500 to $5,000? Shouldn’t deductible affect premium linearly?”

A wise guy responded with the snark that insurance often inspires:

Insurance Can Seem Illogical

Insurance is a big budget item. It costs a lot to protect your home, condo, car and other stuff (we won’t even start on medical insurance).

Insurance seems even more expensive because most of us don’t have claims very often. The average person has 3 or 4 auto accidents in their driving lifetime, and a home insurance claim every 12 years.

Insurance Is Mostly Math – and Math is Logical

The key concept of insurance is that everyone pays a fixed amount each year to avoid paying a huge and uncertain amount if something terrible happens. The money paid by the many goes to the few who have losses.

The typical fire claim is about $45,000. Liability claims average about $22,000, and water damage $9,000. Any of those would be a financial catastrophe for many Americans. Better to pay a fraction of that each year in predicable installments.

Insurance rates aren’t random. Insurance companies submit their rate requests to state insurance departments for approval. Those requests are accompanied by data about loss payments and current projections produced by math nerds called actuaries. The math can be heavy, and the results hard to understand.

Why Aren’t Insurance Deductible Savings Greater?

You might think that increasing your deductible by $1,000 should save twice as much as a $500 increase. That’s because you’re thinking about yourself, and your experience. The insurance company thinks about everyone’s claims, not just yours.

Most Claims are Small

While the average insurance claim is big, most claims are small. For every $100,000 fire claim, there are dozens of $1,500 ones. Think about it: every larger claim exceeds a smaller deductible, but not every claim reaches the larger one.

Insurance Deductible Example

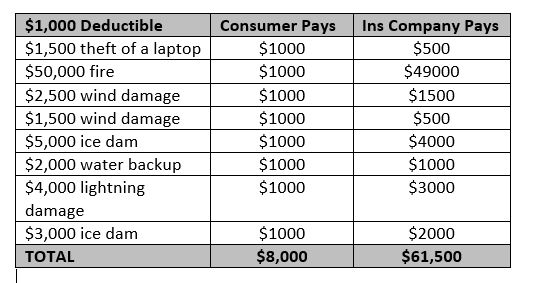

Here’s an example of 3 deductible scenarios using 8 typical claims:

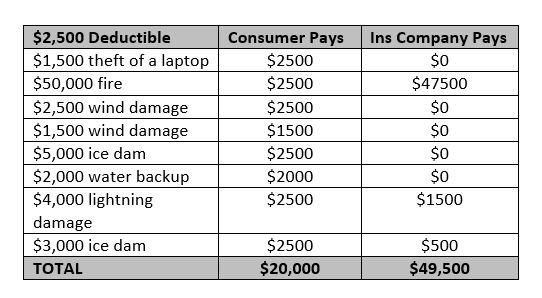

What happens when the deductibles increase to $2,500?

The insurance company sees that they pay 24% more on policies with $1,000 deductibles compared to $2,500 deductibles, so they offer a corresponding discount in their rates.

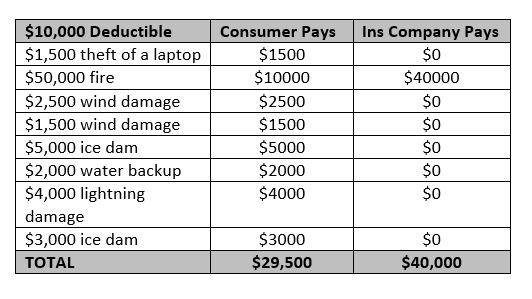

What if the deductibles were $10,000 instead of $2,500?

An individual or business owner might look at those figures and say “I’m taking a lot more risk with a jumbo deductible, so I should get a big discount”.

But the insurance company pays only 19% less, despite the $10,000 deductibles vs. $2500. The insurance company’s risk of claims payments isn’t linear, and so neither are the deductible savings. That’s why you don’t save as much when you buy a much larger deductible.

Logical, no?

Need Insurance Deductible Advice?

Do you live or own a business in Southern Maine? Have questions about your personal or business insurance? Contact a Noyes Hall & Allen Insurance agent in South Portland at 207-799-5541. We offer a choice of several of Maine’s top insurance companies. We can help you choose the most cost-effective property insurance deductible. We’re independent and committed to you.